Based on a $350000 home

Renting provides great flexibility, ideal for those who may need to move frequently or are not yet ready to commit to a single location. It's a predictable expense with known costs upfront, allowing for easier budgeting without the responsibilities of home maintenance and repairs.

However, renting means paying a monthly sum to a landlord without building equity. As rent prices increase, especially in growing markets, renters don't benefit from the investment aspect of homeownership, which can lead to lost opportunity for wealth accumulation.

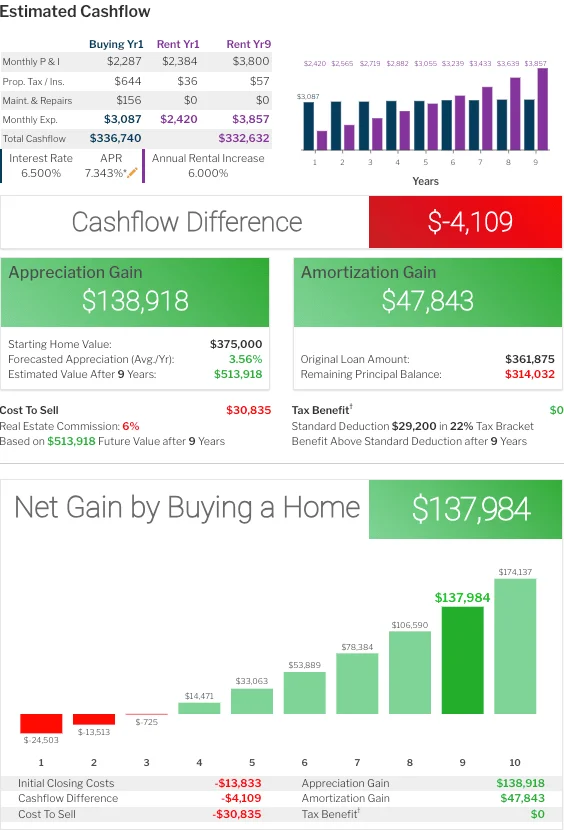

Buying a home is a long-term investment that can contribute to wealth accumulation through building equity. As you pay down your mortgage, you own more of your home outright, and if the property's value increases, so does your potential wealth.

The upfront costs of buying—down payments, closing costs, and other fees—can be substantial, and the ongoing maintenance costs and property taxes add to the financial responsibilities of homeownership. Yet, these investments in your property can pay off over time as you build equity and potentially benefit from the property's appreciation.

The long-term financial planning implications of renting versus buying can be profound. Renters can invest what they save from not having homeownership expenses, potentially earning returns that may outpace the equity they could have built in a home. Conversely, homeowners might benefit from the forced savings of a mortgage and the long-term growth in property value.

Wealth accumulation is more nuanced than simply the value of a property or investment returns. It also includes the stability of owning a home, the predictability of fixed-rate mortgages, and the psychological benefits that come with homeownership.

There's no one-size-fits-all answer to whether renting or buying is better for financial health. It requires a personal assessment of financial readiness, lifestyle preferences, and long-term goals. Whether you choose the path of renting with flexibility or buying with an eye toward investment, the decision should align with your overall financial plan.

For a more in-depth analysis of renting versus buying, and to explore which option may be best for you, keep following our blog. We're here to provide you with the insights you need to make the most informed decisions about your living situation and financial future.

A big thank you to MBS Highway and Barry Habib for their great graphic above.